Environmental, Social & Climate Evaluation

The evaluation and monitoring of environmental, social and climate impacts of projects in credit insurance and investment

Environmental, Social & Climate Evaluation

The evaluation and monitoring of environmental, social and climate impacts of projects in credit insurance and investment.

Environmental, Social and Climate evaluation

Bpifrance Assurance Export insures international projects considering environmental and social impacts, as well as human rights. Assessing the environmental and social impacts of projects is part of the guarantee application process.

Since January 2023, the State guarantee is not granted for the export of goods and services for transactions whose direct purpose is the exploration, production, transport, storage, refining, distribution of coal or liquid /gaseous hydrocarbons, or the production of energy from coal excepted for operations having the effect of :

- reducing the negative environmental impact

- improving the safety of existing installations, or their impact on health, without increasing their lifespan or production capacity,

- aiming at the dismantling or conversion of these facilities.

Bpifrance Assurance Export carries out its environmental and social assessments in accordance with the Recommendation of the Council on OECD Legal Instruments Common Approaches for Officially Supported Export Credits and Environmental and Social Due Diligence. These Common Approaches apply to all types of officially supported export credits for exports of capital goods and/or services (except for exports of military, aeronautical and space equipment, or agricultural products) with a repayment term of two years or more.

The evaluation also aims at insuring that the projects concerned are compliant with local regulations of the host country and with the relevant international standards, mainly those developed by the World Bank and the International Finance Corporation (IFC). Environmental, Social and Human Rights are considered, and the most restrictive standard will be applied.

Environmental and social aspects are therefore fully part of the decision to guarantee credit insurance projects, particularly if the request exceeds €10M, if they are in a sensitive area or if they infringe on human rights. Investment insurance projects are also concerned.

In practice, how do we conduct the ESC assessment?

Each request for credit/investment insurance is accompanied by information on the Environmental and Social Assessment, which may include:

- A project definition/sector

- The amount of the operation (criteria of more or less than €10M )

- The location – geographical scope

- Any compliance with international standards (Common Approaches, IFC, European taxonomy, etc.)

This information is subject to an environmental, social and climate evaluation, which may require additional information from stakeholders as part of the project evaluation and monitoring process.

Environmental and social information collected should enable Bpifrance Assurance Export to classify the project in one of three categories (A, B, C) according to the importance of their potential impacts. Each category has its own environmental and social risk management process and specific requirements. Depending on the evaluated risk, environmental, social and climate conditions may be included in the policy.

› The 3 categories

Category A: project with significant potential impacts, for which an environmental and social impact evaluation is required. This category of operations requires in-depth environmental and social analysis as well as risk monitoring;

Category B: project with lower potential impacts, for which additional information may be required. This category of operations requires a less detailed environmental and social analysis, as risk monitoring is not systematic;

Category C: project with little or no environmental and social impact. This category of operations does not require a detailed environmental and social analysis. No risk monitoring will be required.

If needed, Bpifrance Assurance Export guarantee may also be subject to environmental and social conditions to ensure compliance with the standards in force (monitoring report, site audit, etc.).

› Our transparency obligations

Bpifrance Export Insurance follows transparency obligations regarding its activity, in accordance with the OECD Common Approaches.

This transparency obligation has two different dimensions :

Ex-ante transparency – Before the guarantee is granted

For projects under appraisal that have been classified as Category A only.

This ex-ante transparency is made available to the civil society and local populations affected by projects via Bpifrance Assurance Export website.

In accordance with the OECD Common Approaches, Bpifrance Assurance Export is publishing some documents (e.g. Environmental and social impact assessment). At the request of the buyer or exporter, these documents may have been previously redacted of information whose disclosure could undermine the commercial or industrial confidentiality of the export.

The ex-ante transparency period begins on the date the information is made available on the website, for at least 30 calendar days prior to the final commitment to provide support to the project.

This ex-ante information is provided in accordance with the reporting requirements of the Recommendation of the Council on OECD Legal Instruments Common Approaches for Officially Supported Export Credits and Environmental and Social Due Diligence and it does not imply any prior validation or approval by Bpifrance Assurance Export.

Consult ex-ante publications: Consult the ex-ante transparency form

Ex-post transparency – After the guarantee is granted

For projects classified in category A or B and those relating to contracts of more than €10 million, obtained by French companies and benefiting from a Bpifrance Assurance Export guarantee.This transparency is carried out on a quarterly basis.It provides a description of the projects and, if applicable, essential information on their environmental and social consequences as well as Bpifrance Assurance Export’s monitoring requirements.Here is the information (in French) regarding guaranteed contracts:

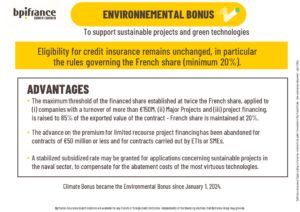

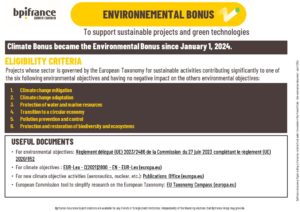

How to get an environmental bonus?

Bpifrance Assurance Export, also known as “climate bank-insurer” and the French government offer preferential export guarantee conditions for climate-sustainable projects in line with the 2020 report to Parliament on the Climate Plan for export financing.

In this context, the Climate Bonus has been made available since January 1, 2021 and enlarged in a Environmental Bonus since January 1, 2024 for all your Credit Insurance applications (in the process of being processed or promised guarantees) that meet eligibility criteria.

The presentation below shows its main advantages.

Consult Environmental Bonus synthesis, the Q&A and the instruction presentation.

Bpifrance Assurance Export initiatives

Bpifrance Assurance Export is involved in several international climate change initiatives. Bpifrance has been one of the founder members of the Export Finance for Future international coalition and was the first credit insurer to adopt the Poseidon Principles.

EQUATOR PRINCIPLES

Bpifrance Assurance Export is joining Equator Principles (EP)!

The Equator Principles (EP) are a financial industry benchmark for determining, assessing and managing environmental and social risk in projects.

129 financial institutions (commercial banks, export credit agencies…) globally are currently Signatories to the Equator Principles. Becoming Equator Principles Financial Institutions (EPFIs), Bpifrance Assurance Export will reinforce its practices on environmental, social and climate standards as already applied through OECD rules, and thus ensure that the projects guaranteed are developed in a socially responsible manner and reflect sound environmental management practices.

This new collaboration with EPFIs marks a significant milestone in strengthening the environmental, social and climate roadmap of Bpifrance Assurance Export globally.

This new partnership will not only enhance the potential for Bpifrance Assurance Export to contribute to a well-recognized international framework but also to pave the way for a more sustainable future for investment and trade.

Denis Le Fers, General Manager of Bpifrance Assurance Export, said: “Joining EP is a major step for Bpifrance Assurance Export. This alliance will help to strengthen environmental and social risk management on projects. EP will also allow to share knowledge with leading international financial institutions and export credit agencies, committed to reinforce their environmental and social framework. Bpifrance Assurance Export looks forward to working with the Equator Principles community.

Bpifrance Assurance Export has formally adhered to the Equator Principles on April 1, 2025. The implementation report is available here.

Home Page – Equator Principles

NET-ZERO EXPORT CREDIT AGENCIES ALLIANCE

Bpifrance Assurance Export is joining Net-Zero Export Credit Agencies Alliance (NZECA) as affiliate !

The UN-convened Net-Zero Export Credit Agencies Alliance (NZECA) unites leading public finance institutions committed to delivering net-zero economies by 2050 by supporting the decarbonization of trade and facilitating joint action from public and private finance.

This first-of-its-kind net-zero finance alliance consists of 9 export credit agencies and export-import banks that together support billions of dollars in international trade.

Becoming NZECA Affiliate, Bpifrance Assurance Export will reinforce its goal towards more sustainability, by supporting the goal of attaining net-zero greenhouse gas emissions and advancing a just transition.

This new cooperation with NZECA members marks a significant milestone in strengthening the environmental, social and climate roadmap of Bpifrance Assurance Export globally.

This new partnership will not only enhance the potential for Bpifrance Assurance Export to contribute to a well-recognized international framework but also to pave the way for a more sustainable future for investment and trade.

Denis Le Fers, General Manager of Bpifrance Assurance Export, said: “Joining NZECA is a major step for Bpifrance Assurance Export. This alliance will help to strengthen a common goal : achieving global net zero by 2050 and limiting global warming to 1.5 degrees. NZECA will also allow to share knowledge with leading export credit agencies, committed to accelerate their transition to net zero. Bpifrance Assurance Export looks forward to working with the alliance NZECA.”

Net-Zero Export Credit Agencies Alliance – United Nations Environment – Finance Initiative

Export Finance For Future

On April 14, 2021, France, along with six other countries, launched an international coalition called « Export Finance for Future (E3F) » whose objective is to direct export financing towards sustainable projects that are consistent with the climate objectives of the Paris Agreement. Today, the coalition includes 10 countries.

Read the Statement of Principles of E3F edited on April 14th, 2021.

Poseidon Principles

In 2020, Bpifrance Assurance Export signed the Poseidon Principles. This initiative was launched by international banks actively financing shipping to measure and publish the carbon impact of their civil ship portfolios using a common methodology.

Visit the website: Poseidon Principles for Financial Institutions

In addition, during COP26, France decided to end foreign public financing of certain fossil fuel projects by the end of 2022 signing the Statement on international public support for the clean energy transition. The new 2023 Finance Act reflects this commitment.

Reference documents

Recommendation of the Council on OECD Legal Instruments Common Approaches for Officially Supported Export Credits and Environmental and Social Due Diligence

The Common Approaches are applicable to all OECD Member countries and are reviewed periodically. The latest version was adopted on 7 April 2016 by the OECD Council. It strengthens the provisions related to greenhouse gases, social impacts of projects and human rights.

In addition, Annex IV of the OECD Arrangement, encourages the export of advanced environmental technologies and applies to projects that contribute to climate change mitigation.

The International Finance Corporation’s (IFC) performance criteria

The IFC’s eight Performance Standards (PS) define the environmental, social, health and safety sustainability criteria that must be met throughout the life of an investment.

Discover the eight performance standards

The World Bank Group’s sectoral environmental, health and safety guidelines

Environmental, health and safety (EHS) guidelines are technical reference documents containing general and specific examples of good international industrial practice (GIIP).

Discover the World Bank EHS guidelines

The World Bank’s environmental and social safeguard policies

The World Bank’s current environmental and social policies (ESPs) are called Safeguard Policies. They ensure that projects comply with international environmental and social standards.

Discover the World Bank’s ESPs

The Report to Parliament 2020: Climate plan for export finance

In October 2020, the Government submitted a report to Parliament on its climate strategy for public export financing.

Our partners

Other offers you might be interested in